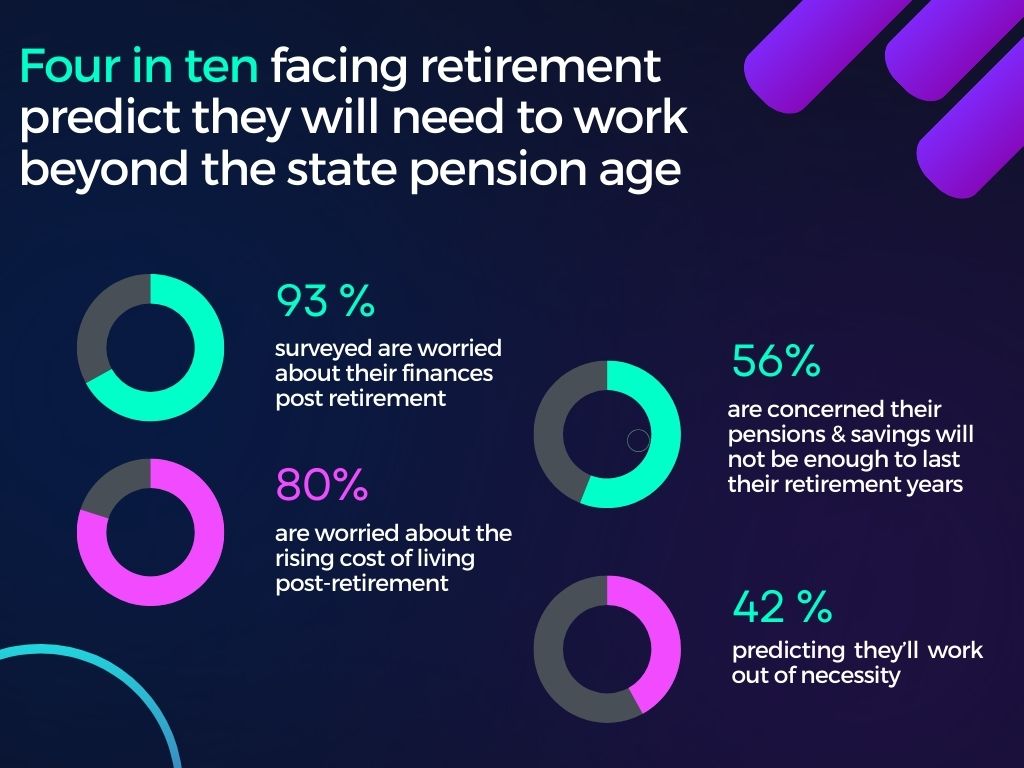

New research reveals that 93% of employees surveyed said they are worried about their finances post-retirement, with 80% citing the rising cost of living as a key concern.

As many as 56% felt that their pensions and savings won’t be enough to last their retirement years.

In research carried out by Renovo, 43% of those surveyed facing retirement predict they will work beyond the state pension age, as they are increasingly concerned about financial, health and lifestyle issues in later careers.

Initial survey questions were completed by 629 HR professionals and company directors. Of those surveyed, 253 respondents currently provide pre-retirement support to employees. Of 986 employees surveyed, 256 have utilised pre-retirement support from their employer within the last 5 years.

Chris Parker, Managing Director of Renovo, said, “The retirement picture is far more complex and pressured than it has been historically.

“With no default retirement age and a rising state pension age, we are seeing people increasingly struggle to make firm decisions on when and how to retire.

“People are generally living longer which means more pension savings are needed and those approaching retirement are now more likely to have financially dependent children while at the same time caring for elderly parents.

“These are all financial pressures that significantly impact people’s plans for retirement, which are of course greatly exaggerated by the rising cost of living crisis.

“Unsurprisingly, with finances being squeezed, finding opportunities to work for longer is becoming necessary for many. This impacts employers immeasurably too – not just in terms of rising occupational health risks and costs but also in terms of talent mobility and succession planning.”

Beyond financial concerns

Renovo’s study found that it’s not just financial problems employees are worried about as they approach retirement.

Other concerns cited included maintaining physical health (50%), remaining productive (40%), loneliness (39%) and the impact on personal relationships (17%).

Only 1 in 5 employers provide pre-retirement support

Renovo’s research also discovered that only 1 in 5 employers provide any sort of pre-retirement support. The research shows that, of the limited number of respondents that do receive support, only half received information on financial education, 24% on mental and emotional health in retirement and 22% on physical health in retirement.

Support needed earlier in employees’ careers

Earlier access to information and support was also a factor demonstrated in Renovo’s study, with 78% of employees wishing they’d received more information about pensions and savings earlier on in their career.

Chris added, “Supporting employees earlier means organisations can benefit from having employees who have a clear plan for the later stages of their careers and are motivated around those plans.

“Just a quarter (24%) of the survey respondents say the support they received covered later stage career planning – and with people feeling they need to work longer this is becoming increasingly important.

“Employees who are able to be more transparent about their intentions with their managers plus take more control of the later stages of their careers provide more visibility to their employers enabling effective succession and workforce planning.”

Jen Gaster, Founder and Managing Director of HR Heads, said, “It’s not a huge surprise to see Renovo’s data, especially with regards to the low percentage of organisations offering pre-retirement support.

“However, it is absolutely crucial that businesses start to embed this important area of human resources in their policies – and offer employees the best possible support in advance of retirement.

“Clearly this falls on the HR function to implement these policies, and as the state pension age rises we will see the need for pre-retirement support increase exponentially.

“Looking to the future of HR jobs we may very well see roles specifically created to help with pre-retirement support as well-being spans more than mental health.

“Financial well-being is a considerable factor and one that impacts hugely on people’s overall well-being. Hopefully, this will be reflected with an increase in the number of employers offering assistance in this area.”